Beginner’s Guide

Popular Cryptocurrencies – Purpose, Pros, Cons, Alternatives & Future

New to crypto? This layman-friendly guide explains the biggest coins — what they do, why people like them, their downsides, typical trading volume (high level), better alternatives, and where they might be headed.

1) Bitcoin (BTC)

Purpose: Often called “digital gold,” meant for storing value and sending money without banks.

- Most trusted and widely accepted

- Fixed supply (21 million) — no inflation printing

- Slower and can be costly during congestion

- Energy-intensive mining

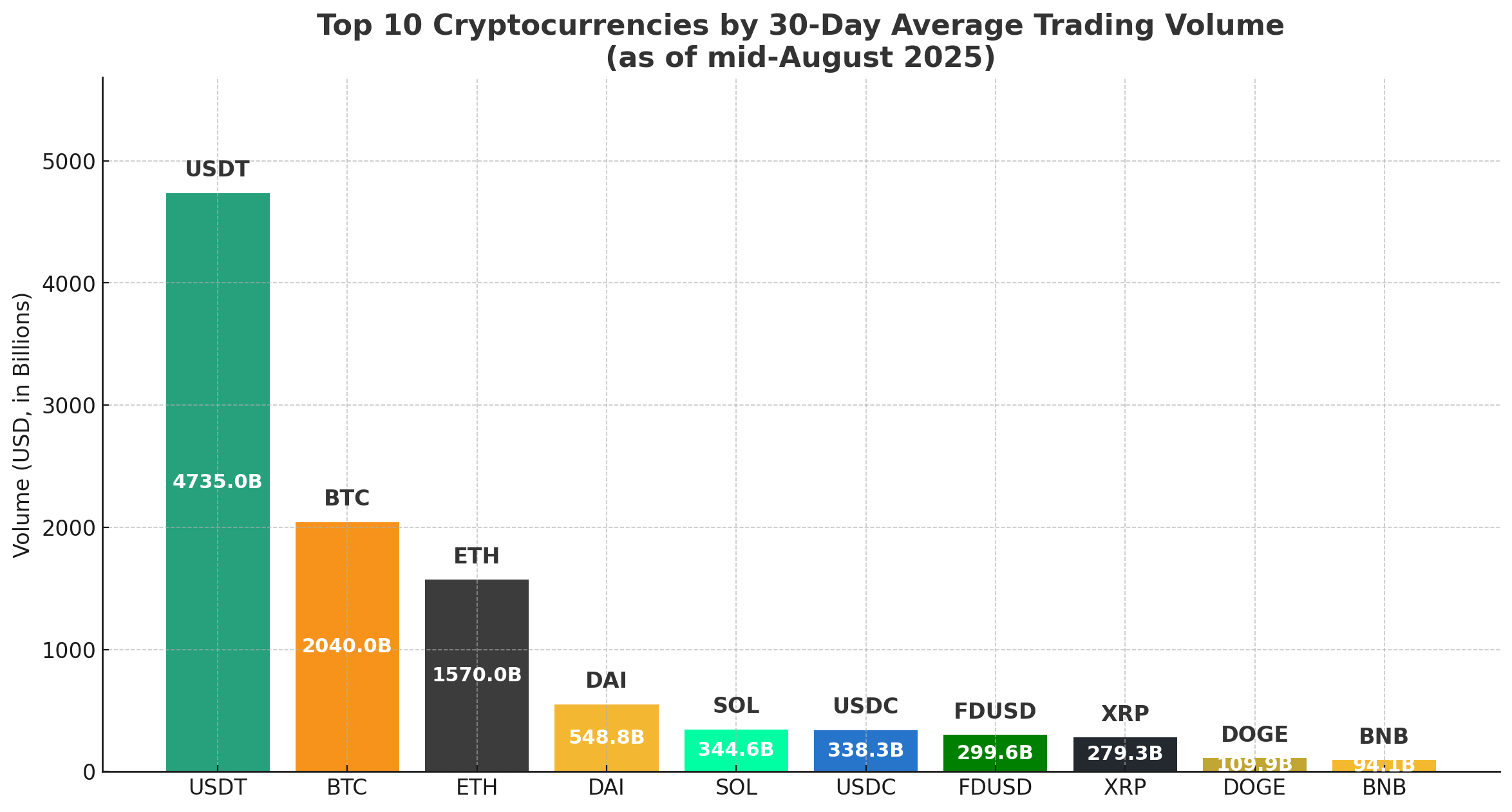

Volume (high level): Consistently the largest by market cap and daily trading value.

Better alternatives (use case): For faster/cheaper payments: Litecoin Bitcoin Lightning Solana

Future: Likely to stay the benchmark “store of value”; scaling tools (e.g., Lightning) may improve payments.

2) Ethereum (ETH)

Purpose: Runs smart contracts and decentralized apps (DeFi, NFTs, games).

- Huge developer ecosystem and tooling

- Green(er) staking model; ongoing upgrades

- Fees can spike during busy periods

- Learning curve for beginners

Volume: Second only to Bitcoin; highly liquid.

Better alternatives (low fees): Polygon Solana Avalanche

Future: Expected to remain the leading smart-contract platform as scaling improves.

3) Solana (SOL)

Purpose: High-speed, low-fee chain for apps, payments, and NFTs.

- Very fast, very cheap transactions

- Strong traction for consumer apps/NFTs

- Past network outages

- Competes with several fast L1s

Volume: Among the top traded altcoins.

Better alternatives: Avalanche Algorand

Future: Attractive if stability keeps improving and developer growth continues.

4) Ripple (XRP)

Purpose: Super-fast, low-cost cross-border payments, used by some financial institutions.

- Seconds-level settlement and tiny fees

- Bank/fintech partnerships

- Legal/regulatory uncertainty in some regions

- More centralized than many others

Volume: Typically top-10 by market cap/liquidity.

Better alternatives: Stellar (XLM)

Future: Hinges on regulatory clarity and bank adoption.

5) Cardano (ADA)

Purpose: Research-driven, energy-light smart-contract platform.

- Energy efficient, structured upgrades

- Low fees

- Slower rollout vs. competitors

- Lower mainstream app adoption (for now)

Volume: Commonly top-15 by market cap.

Better alternatives: Ethereum Solana

Future: Potential if ecosystem apps/users expand steadily.

6) Stablecoins (USDT / USDC)

Purpose: Digital tokens pegged to a stable asset (usually 1 token ≈ 1 USD) for easy trading and saving.

- Low volatility; great for moving money between exchanges

- Useful for DeFi lending/borrowing

- Trust depends on issuer reserves and audits

- Increasing regulatory scrutiny

Volume: Among the most traded assets in crypto.

Better alternatives: Choose the one with transparency you trust (many prefer USDC for disclosures).

Future: Likely to grow with payments and DeFi, within tighter regulations.

Quick Comparison Table

| Cryptocurrency | Purpose | Pros | Cons | Volume / Status | Better Alternatives | Future (Layman View) |

|---|---|---|---|---|---|---|

| Bitcoin (BTC) | Digital gold; value storage & payments | Most trusted; capped supply | Slow; energy heavy | Largest by market cap/liquidity | Litecoin, Lightning, Solana | Likely long-term store of value |

| Ethereum (ETH) | Smart contracts & apps | Big dev community; upgrades | Fees can spike | #2 by market cap/liquidity | Polygon, Solana, Avalanche | Remains core app platform |

| Solana (SOL) | Fast, low-fee apps/NFTs | Quick & cheap | Past outages | Top traded altcoin | Avalanche, Algorand | Bright if stability holds |

| Ripple (XRP) | Cross-border payments | Very fast; low fees | Regulatory uncertainty | Top-10 market cap | Stellar (XLM) | Depends on legal clarity |

| Cardano (ADA) | Eco smart-contract chain | Energy-light; low fees | Slower adoption | Top-15 market cap | Ethereum, Solana | Improves if apps grow |

| Stablecoins (USDT/USDC) | Stable on-chain cash | Low volatility; DeFi utility | Issuer/reserve risk | Highest trading turnover | — choose transparency | Likely mainstream with regs |

Note: “Volume/Status” is a simplified, high-level view for beginners. Exact volumes change daily.

New Investor Tips (Simple & Safe)

- Start small; learn wallets, fees, and basic security first.

- Use reputable exchanges (enable 2FA and strong passwords).

- Never share seed phrases; consider hardware wallets for long-term holding.

- Diversify; don’t chase hype or “get-rich-quick” promises.

- Have a plan: amount, time horizon, and exit rules.

Keep learning: How to Start Investing in India · Best Crypto Wallets for Beginners · DeFi Explained

FAQs

Which crypto should a beginner try first?

Many start with Bitcoin or Ethereum because they’re widely supported and have lots of learning resources.

How much is safe to invest?

Only what you can afford to lose. Crypto is highly volatile; consider it a high-risk part of your portfolio.

Where do I store my crypto?

Short-term traders use exchange wallets. Long-term holders often use hardware wallets for extra security.

Are fees important?

Yes. Fees vary by network and exchange. Low-fee chains (e.g., Solana, Polygon) are helpful for small transfers.

“Thanks for sharing such valuable information!”

“I appreciate the detailed explanation, very helpful!”