Major Cryptocurrencies in 2025

Cryptocurrencies continue to evolve as a central pillar of the global financial landscape. From Bitcoin’s dominance as “digital gold” to the rise of smart contract platforms and stablecoins driving liquidity, each major asset plays a distinct role. This article provides a comprehensive breakdown of the major cryptocurrencies of 2025 – Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP), Cardano (ADA), and Stablecoins (USDT/USDC) — covering their purpose, underlying technology, security, institutional adoption, and daily trading activity as of 2025.

Bitcoin (BTC)

- Primary Purpose: Store of value, hedge against inflation, and a decentralized alternative to gold.

- Technology: Proof-of-Work (mining-intensive, energy-demanding).

- Security: The most secure and decentralized blockchain with the largest hash power.

- Adoption: Held by governments like the U.S. ($750M), and El Salvador (~6,102 BTC). Institutional investors increasingly see it as a reserve asset.

- Daily Trading Volume: ~$36B (Binance), with some reports suggesting >$100B globally.

Ethereum (ETH)

- Primary Purpose: Smart contracts, decentralized finance (DeFi), non-fungible tokens (NFTs), and dApps.

- Technology: Proof-of-Stake (since “The Merge,” far more energy efficient than PoW).

- Security: Highly secure with a broad validator network.

- Adoption: U.S. Strategic Reserves include ETH; notable holders include Trump (~$1–5M in ETH). Institutional usage growing rapidly.

- Daily Trading Volume: ~$19–40B depending on exchange and reporting.

Solana (SOL)

- Primary Purpose: High-speed blockchain supporting DeFi, NFTs, and scalable applications with low fees.

- Technology: Proof-of-History combined with Proof-of-Stake.

- Security: Fast and efficient but has faced network outages; decentralization concerns remain.

- Adoption: ETF filings by 21Shares highlight institutional interest.

- Daily Trading Volume: ~$3.8B–6B across exchanges.

Ripple (XRP)

- Primary Purpose: Cross-border payments and global remittances, connecting fiat and crypto systems.

- Technology: XRP Ledger consensus via trusted node lists.

- Security: Efficient and secure, though validator model is more centralized.

- Adoption: SEC settlement in the U.S. has improved legitimacy; Ripple is considered an ETF candidate. Partnerships with financial institutions strengthen its use case.

- Daily Trading Volume: ~$5–6B.

Cardano (ADA)

- Primary Purpose: Decentralized applications, smart contracts, and governance-driven blockchain solutions.

- Technology: Proof-of-Stake (Ouroboros protocol).

- Security: Highly secure, though development and adoption are slower compared to ETH and SOL.

- Adoption: Implemented in Ethiopia and Georgia for supply chain and identity systems; tested by companies like New Balance for tracking.

- Daily Trading Volume: ~$2B.

Stablecoins (USDT / USDC)

- Primary Purpose: Stability, liquidity, and seamless trading; widely used in DeFi and remittances.

- Technology: Centralized issuance, backed 1:1 with USD reserves.

- Security: Dependent on issuer transparency and reserve audits.

- Adoption: Circle (issuer of USDC) backed by Goldman Sachs, BlackRock, and Fidelity; USDT remains dominant despite reserve scrutiny. Regulatory frameworks like U.S. CLARITY Act and EU MiCA are shaping stablecoin oversight.

- Daily Trading Volume: USDT ~$75–91B; USDC ~$6–13B.

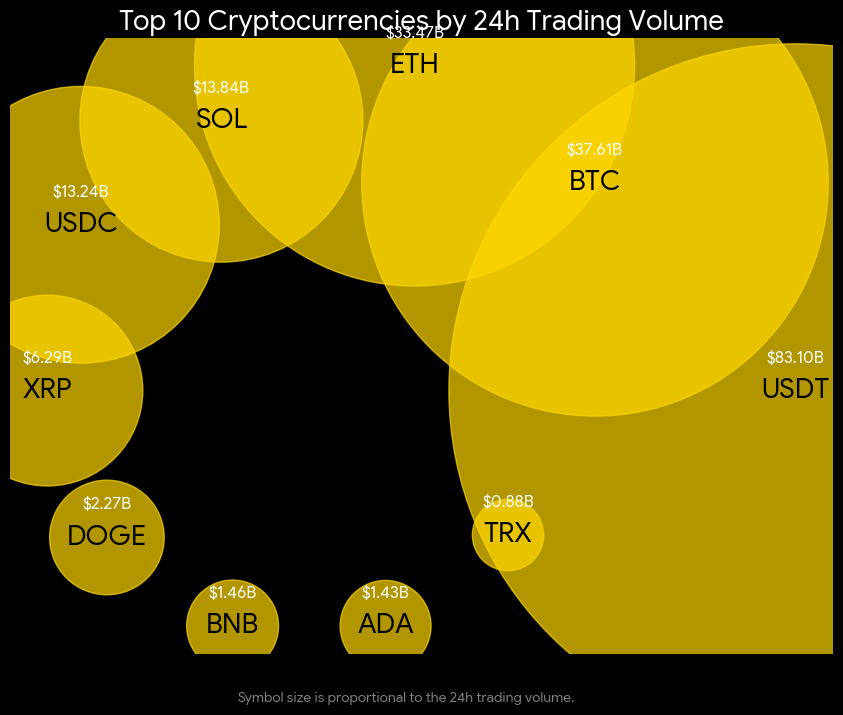

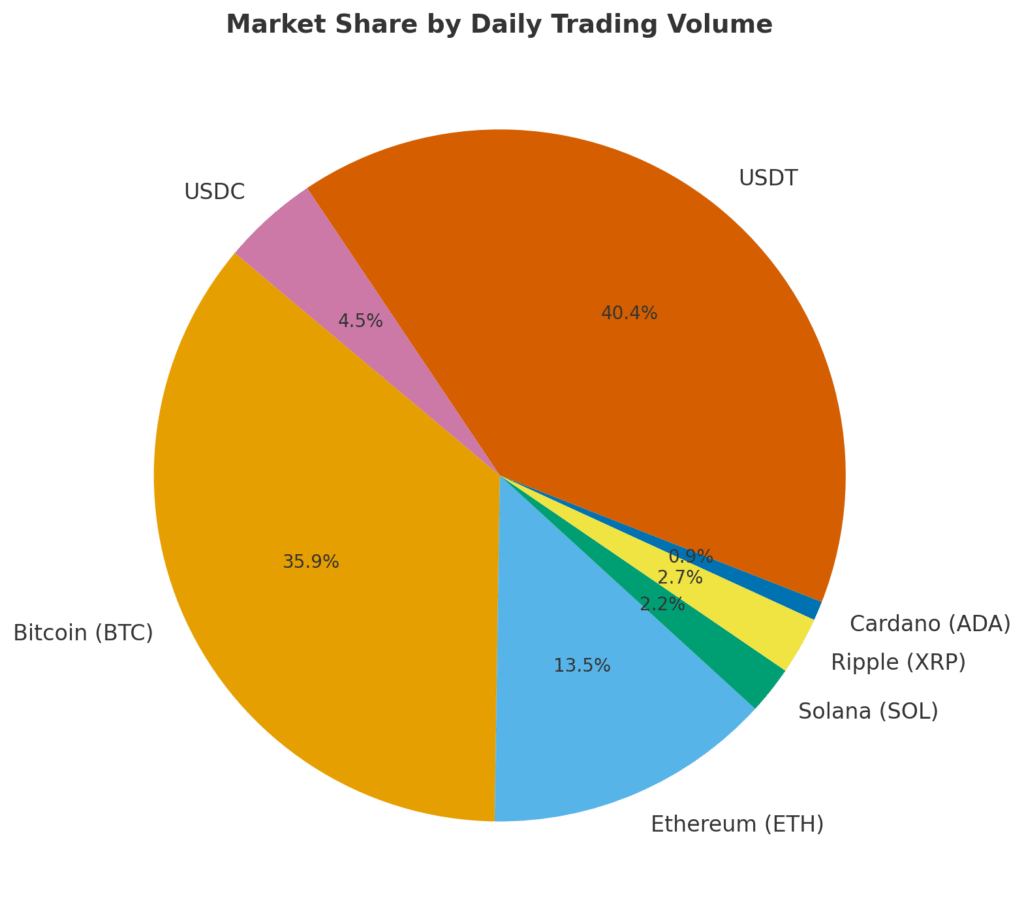

Major Cryptocurrencies in 2025: Above is an illustration of Market share by the Top Cryptocurrencies

| Crypto | Purpose & Use Case | Consensus / Issuance Mechanism | Security | Institutional / Government Adoption | Average Daily Volume (24h) |

|---|---|---|---|---|---|

| Bitcoin (BTC) | Digital gold, store of value, hedge against inflation | Proof-of-Work (mining) | Strongest network security, decentralized | U.S. holds ($750M BTC) & El Salvador (~6,102 BTC) Wikipedia+1 | ~$36B per Binance report; some sources >$100B BinanceUPay Blog |

| Ethereum (ETH) | Smart contracts, DeFi, NFTs, dApps | Proof-of-Stake (since “Merge”) | Highly secure, broad validator base | Trump owns $1–5M in ETH; institutional usage rising WikipediaThe Washington Post | ~$19–40B BinanceUPay Blog; ~$40B from CoinGecko CoinGecko |

| Solana (SOL) | Fast, low-fee blockchain for DeFi, NFTs, apps | Proof-of-History + PoS hybrid | Fast consensus but past outages raise concerns | 21Shares filed for a U.S. SOL ETF Wikipedia | ~$3.8B–6B BinanceCoinGeckoUPay Blog |

| Ripple (XRP) | Cross-border payments, remittances | XRP Ledger consensus (unique node list) | Secure, but centralized validator concerns | SEC settlement improving legitimacy; ETF hopeful Barron’sIndiatimesWikipedia | ~$5.8B Binance; XRP ~$5–6B CoinGeckoCoinCarp |

| Cardano (ADA) | Peer-reviewed smart contracts, governance | Proof-of-Stake (Ouroboros) | Secure design; rollout is slower | Deployed in Ethiopia, Georgia for supply chain & ID Wikipedia | ~$2B BinanceCoinCarp |

| USDT / USDC (Stablecoins) | Liquidity, trading, DeFi, payments | Centralized issuance (backed 1:1 USD) | Security tied to issuer’s reserves/trust | Circle IPO backed by Goldman Sachs, BlackRock, Fidelity Wikipedia; regulatory discussions ongoing The TimesBarron’s | USDT ~$91B, USDC ~$6.5B Binance; other sources: USDT ~$75B, USDC ~$13B |

Above is a summary of the Major Cryptocurrencies

Key Takeaways

Bitcoin and Ethereum remain the foundation — BTC as a long-term store of value and ETH as the leading smart contract platform.

Solana, XRP, and Cardano provide specialized alternatives: speed, institutional payments, and governance-focused apps respectively.

Stablecoins underpin global crypto liquidity, enabling trading, hedging, and DeFi yield generation.

Institutional and even government-level adoption is accelerating, from Bitcoin reserves to stablecoin-backed IPOs.

As the market matures, these six pillars will continue to shape both the investment landscape and the broader integration of blockchain into everyday finance. Please go through the articles https://finclaritas.com/crypto-investing-safe-smart-strategies/ and https://finclaritas.com/cryptocurrency-guide-types-pros-future/, which explain Cryptocurrencies in a simplified manner.

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice.